Best Installment Loans: Compare Rates & Apply

Welcome to your go-to resource for exploring flexible financing solutions. Whether you’re handling surprise expenses or planning a major purchase, finding the right credit option matters. This guide cuts through the noise to highlight lenders with fair terms and transparent processes.

Life’s unexpected moments—like medical bills or home repairs—often demand quick decisions. We simplify your search by breaking down interest rates, repayment timelines, and approval criteria from trusted U.S. providers. No jargon, just clear information to help you compare options confidently.

Our tools let you evaluate offers side by side, saving time and stress. Learn how to balance affordability with your unique needs, whether you’re consolidating debt or funding a project. Knowledge is power, and we’re here to equip you with both.

Key Takeaways

- Access top-rated lenders offering competitive rates and adaptable terms

- Compare approval requirements and repayment plans in one place

- Understand how your credit profile impacts borrowing options

- Simplify decision-making with transparent fee structures

- Learn strategies to secure favorable conditions for your budget

Introduction to Installment Loans

Ever wondered how millions manage large expenses without maxing out credit cards? Structured repayment plans offer a smart alternative. An installment loan lets you borrow a set amount upfront, then repay it through fixed monthly payments until you’ve cleared the balance.

This type of financing works differently than revolving credit. With credit cards, your available balance fluctuates as you spend and pay. But installment agreements give you predictable payment dates and amounts. No guessing games—just a clear path to becoming debt-free.

Why do people choose this option? Stability. Knowing your exact monthly payment helps budget effectively. Whether covering car repairs or consolidating bills, it prevents surprises. Plus, many lenders report timely payments to credit bureaus, which can boost your score over time.

| Feature | Installment Option | Credit Card |

|---|---|---|

| Payment Structure | Fixed monthly amount | Minimum + variable interest |

| Term Length | 6 months – 7 years | Open-ended |

| Interest Type | Fixed or variable | Variable APR |

Common uses range from medical bills to home upgrades. Lenders often approve these faster than mortgages but require proof of income. Always compare offers—terms vary widely between providers.

Understanding Installment Loans: How They Work

Navigating financial solutions doesn’t have to feel like solving a puzzle. Let’s break down how structured borrowing arrangements operate, giving you clarity and control over your finances.

What Is This Type of Financing?

Imagine receiving funds upfront for a car repair or home project, then repaying the amount in equal chunks. That’s the core idea. Whether you’re eyeing a new vehicle or consolidating bills, this approach offers a fixed schedule. You’ll know exactly what’s due each month—no surprises.

Breaking Down the Payment Plan

Your repayment strategy combines the borrowed amount with interest, split evenly across months or years. Shorter timelines mean higher monthly payments but less interest overall. Longer plans ease cash flow but cost more over time. Here’s a quick comparison:

| Term Length | Monthly Commitment | Total Interest | Flexibility |

|---|---|---|---|

| 12 Months | $450 | $320 | Low |

| 36 Months | $180 | $780 | High |

Every payment chips away at your balance. By the final due date, you’re debt-free. This predictability helps align with paychecks and bills, making budgeting simpler than guessing credit card minimums.

Advantages of Installment Loans for Your Financial Goals

Financial stability often starts with predictable payment schedules. Knowing your exact monthly obligation lets you align repayments with income cycles. This setup helps avoid the stress of fluctuating bills while building a reliable routine for managing debt.

Structured agreements shine when budgeting. You’ll never guess minimum payments—each month’s amount stays locked in. This clarity makes it easier to plan for groceries, utilities, and savings goals without surprises.

Consistent payments do more than clear balances. Most lenders report to credit bureaus, so timely actions can boost your score. Over time, this positive history diversifies your credit mix, which accounts for 10% of FICO® scores.

| Feature | Installment Option | Credit Card |

|---|---|---|

| Payment Predictability | Fixed monthly amount | Variable minimums |

| Debt Timeline | Clear end date | Open-ended |

| Credit Impact | Builds history | High utilization risks |

Need funds quickly? Online applications take minutes, with approvals often same-day. Terms adapt to your needs—choose shorter periods to save on interest or extend timelines for lower monthly commitments.

Combining multiple debts into one payment is another perk. You could slash interest rates and simplify tracking. Instead of juggling due dates, focus on a single target while watching your balance shrink.

Key Features of a Personal Installment Loan

Choosing the right financial tool requires understanding its core benefits. Personal installment options stand out through adaptable structures and clear cost expectations. Let’s explore what makes them a practical choice for planned expenses or unexpected needs.

Competitive Rates and Flexible Terms

Many borrowers appreciate fixed interest rates that stay consistent over time. Unlike credit cards with variable APRs, this predictability helps maintain stable budgets. You’ll know exactly how much goes toward principal versus interest each month.

Lenders typically offer repayment windows from six months to seven years. Shorter timelines save money on rates, while longer plans reduce monthly strain. Most providers let you select amounts between $500 and $35,000, adapting to various financial goals.

| Feature | Personal Option | Credit Card |

|---|---|---|

| Rate Type | Fixed | Variable |

| Fees | Transparent | Hidden charges common |

| Debt Timeline | Defined end date | Revolving balance |

Online applications simplify the process—complete forms in minutes and receive decisions faster than traditional methods. Many institutions disclose all costs upfront, including origination fees or prepayment penalties.

- Fixed monthly payments ease budget planning

- No collateral required for most options

- Fast funding after approval

These features make personal installment agreements ideal for consolidating high-interest debt or funding home improvements. Always compare multiple offers to secure terms matching your financial capacity.

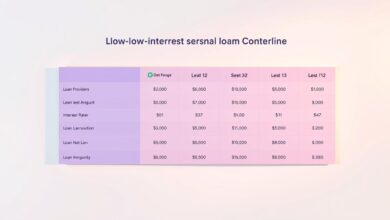

How to Compare Rates and Terms from Top Lenders

Finding the best financial partner requires smart comparison strategies. Not all lenders operate the same way, and small differences can impact your budget significantly. Let’s explore what separates average offers from exceptional ones.

What Really Matters in Lender Offers

Start by looking at the APR—not just the interest rate. This number includes fees, giving a true cost picture. A low rate might hide expensive origination charges or late penalties.

Check eligibility rules before applying. Some lenders work with fair credit scores, while others demand excellent history. Income requirements and employment verification processes also vary widely.

| Lender Feature | Quick Funding | Flexible Terms | Prepayment Rules |

|---|---|---|---|

| Provider A | Same-day | 6-60 months | No penalties |

| Provider B | 2 business days | 12-84 months | 3% fee |

Speed matters when you need cash fast. Compare funding timelines—top lenders deposit funds within 24 hours. Others take longer, which could delay urgent repairs or bills.

Don’t overlook customer support. Read reviews about response times and problem resolution. You want help available when questions arise about payments or documents.

- Ask about payment date adjustments

- Verify autopay discounts

- Check for credit score tracking tools

Remember, your final offer will vary based on income stability and credit history. Always request quotes from 3-5 lenders to find your best match.

Fast and Simple Online Application Process

Need funds without paperwork hassles? Modern digital platforms have transformed how Americans access financial solutions. Today’s streamlined systems let you complete applications faster than ordering takeout—often while waiting for your coffee.

Easy Online Application Steps

Start by entering basic details like your name and contact information. Most forms take 5-7 minutes—quicker than filling a grocery cart online. You’ll typically need:

- Government-issued ID number

- Recent pay stubs or bank statements

- Employment verification details

Quick Verification of Income and Identity

Lenders use secure technology to confirm your details in real-time. Bank-level encryption protects your information while automated checks cross-reference data. This eliminates faxing documents or mailing proofs.

| Feature | Traditional Process | Modern Process |

|---|---|---|

| Time Required | 2-3 days | Under 10 minutes |

| Documentation | Physical copies | Digital uploads |

| Approval Speed | 5 business days | Instant decisions |

| Security | Mail risks | 256-bit encryption |

Once approved, e-sign your agreement with a few clicks. Funds often hit accounts the same day—no notary visits or branch appointments needed. Clear status updates keep you informed at every step.

Quick Approval and Instant Funding Options

Need cash faster than ordering pizza? Modern financial solutions now deliver funds in minutes, not days. This speed revolution lets you handle emergencies without waiting for paper checks or slow transfers.

Approved applicants often see money hit their accounts within 30 minutes when using debit card funding. Visa cards typically process fastest, while MasterCard might take longer due to bank rules. Always check with your card issuer about transfer limits.

Funding Timelines and Debit Card Options

| Method | Speed | Best For | Bank Compatibility |

|---|---|---|---|

| Debit Card | 15-90 minutes | Immediate needs | Visa preferred |

| ACH Transfer | Same day | Next-day bills | All major banks |

| Paper Check | 3-5 days | No rush situations | N/A |

Same-day funding through bank transfers works well for planned expenses. Most lenders complete ACH deposits by 5 PM local time. Miss the cutoff? Funds arrive next business morning.

Your bank account type matters too. Credit unions might process transfers slower than national chains. Mobile banking apps often show deposits faster than website dashboards.

Pro tip: Update your lender if changing funding methods mid-application. A quick call could save hours of waiting.

Understanding Interest Rates, APR, and Loan Costs

Deciphering loan costs starts with understanding two key letters: A-P-R. While interest rates show what you’ll pay annually to borrow money, APR reveals the full picture—including fees. This difference can save or cost you hundreds.

What’s Hiding in Your Loan Agreement?

Lenders calculate APR by combining your interest rate with origination fees and other charges. A Wisconsin example shows how this works: borrowing $500 at 362.04% APR costs $418.42 in fees over four months. That’s nearly the original amount borrowed added back in charges.

Real Payment Comparisons

Payment frequency changes your total cost. Let’s break down two Wisconsin scenarios:

| Payment Plan | APR | Total Fees | Schedule |

|---|---|---|---|

| Monthly | 362.04% | $418.42 | 4 payments |

| Bi-weekly | 358.99% | $364.29 | 8 payments |

The bi-weekly option saves $54.13 simply by splitting payments. Smaller, more frequent payments reduce interest buildup. Always ask lenders for multiple schedule options—this flexibility could keep more money in your pocket.

Your credit score and income affect your rate, but comparing complete packages matters most. Look beyond the loan amount to total repayment figures. Smart choices today prevent budget surprises tomorrow.

The Impact of Credit and Income on Loan Approval

Securing financing often feels like solving a complex equation—but it doesn’t have to. Lenders review multiple factors beyond your three-digit credit score. Your employment history, debt-to-income ratio, and even banking habits can sway decisions. This holistic approach helps providers assess your true repayment capacity.

Evaluating Your Eligibility

A steady income stream matters as much as your payment history. Providers want assurance you can manage monthly obligations without strain. Recent job changes or irregular earnings might raise questions, but consistent deposits help build trust.

| Factor | Credit Focus | Income Focus |

|---|---|---|

| Weight in Decision | 35% | 45% |

| Ideal Range | 670+ FICO® | Debt ≤40% income |

Don’t assume a thin credit file disqualifies you. Many partners consider rent payments, utility bills, or education history. Recent financial missteps? Explain them upfront—transparency can turn maybes into approvals.

Installment terms often adapt to your situation. Those with higher earnings might secure better rates despite average scores. Conversely, excellent credit could offset moderate income levels. Always highlight strengths in your application.