Consolidation Loans: Combine Debt into One Simple Payment

Juggling multiple bills each month? You’re not alone. Between credit card balances, personal loans, and other obligations, keeping track of due dates and interest rates can feel like a full-time job. It’s easy to miss a payment or lose sight of your progress—especially when high-interest charges keep piling up.

What if you could streamline your payments into one predictable amount? Debt consolidation offers a way to simplify your finances by merging what you owe under a single plan. This approach can reduce stress, lower your overall interest costs, and help you pay off balances faster.

In this guide, we’ll break down how combining debts works and share practical strategies to match your goals. You’ll learn three proven methods for tackling what you owe, compare different financial tools, and discover how to pick the right path for your budget and lifestyle.

Key Takeaways

- Simplify multiple payments into one monthly plan

- Potentially reduce interest rates and save money

- Choose from various strategies based on your needs

- Understand how credit health affects your options

- Create a clear timeline for becoming debt-free

Introduction to Debt Consolidation

Handling various debts with different interest rates complicates budgeting. Debt consolidation merges multiple balances into one manageable plan. This strategy replaces scattered due dates with a single monthly payment, helping you avoid missed deadlines.

Many Americans juggle credit card balances, student obligations, and personal financial responsibilities. Combining these into one account simplifies tracking and reduces stress. You’ll spend less time organizing bills and more time focusing on repayment goals.

Lower interest rates are another potential benefit. High-cost balances from store cards or medical bills often drain budgets. A combined approach could slash your overall costs, freeing up cash for faster progress.

Understanding how this process works is key to success. It’s not just about convenience—it’s a strategic move to regain control. By consolidating your debts, you create a clear timeline to improve your credit health and achieve financial freedom.

How Consolidation Loans Simplify Your Finances

Keeping track of numerous accounts each month eats into your time and peace of mind. A consolidation loan transforms this chaos into clarity by wrapping multiple balances into one predictable monthly payment. Imagine replacing scattered due dates with a single deadline—no more guessing which bills need attention first.

Streamlined Payments for Better Budgeting

This strategy works by using a lump sum to clear existing debts. You’ll trade credit card statements, medical bills, and other obligations for one fixed amount each month. Benefits include:

- No more juggling 5+ payment dates

- Fixed monthly costs for easier planning

- Fewer late fees from missed deadlines

One borrower shared: “Tracking seven accounts felt like drowning. Now I have breathing room to focus on savings.”

Lower Interest and Reduced Burden

High-interest debts—like store cards charging 25% APR—slow progress. Consolidation loans often offer lower rates, shrinking your total costs. For example:

- $15,000 debt at 18% → 11% rate saves $1,200 yearly

- Shorter repayment timelines (3-5 years vs. decades)

This approach turns overwhelming debt into a clear finish line. You’ll spend less on interest and more on what matters—your financial freedom.

Benefits of Debt Consolidation

Balancing multiple debts often leads to stress and confusion. Combining what you owe into one plan offers both practical and emotional advantages. Let’s explore how this strategy can transform your financial routine.

Simplified Monthly Commitments

Managing five or more due dates each month is exhausting. With a single payment, you’ll spend less time tracking deadlines and more time focusing on progress. One predictable amount replaces guesswork, reducing late fees and credit score damage.

Consider these comparisons:

| Multiple Payments | Consolidated Plan | |

|---|---|---|

| Due Dates | 5-10 different days | 1 fixed date |

| Interest Rates | 18-29% (credit cards) | 8-15% (average) |

| Monthly Amount | $700+ scattered | $450 fixed |

Long-Term Financial Advantages

Lower interest rates mean more money stays in your pocket. For example, shifting $15,000 from 24% APR cards to a 12% plan saves $1,800 yearly. These savings accelerate debt freedom.

Your credit health improves as consistent payments rebuild trust with lenders. Over time, this opens doors to better rates on mortgages or car financing. Financial clarity replaces anxiety, letting you plan for vacations or retirement confidently.

“I stopped worrying about missing payments and finally saw light at the end of the tunnel,” shares Maria, a teacher from Ohio. Stories like hers show how simplicity breeds success.

Reviewing Debt Repayment Strategies

Choosing how to tackle debt can feel overwhelming. Three proven approaches help simplify the process: the snowball method, avalanche method, and combining debts. Your personality and budget determine which strategy works best.

Debt Snowball Method

This approach focuses on quick wins. Pay minimums on all debts except the smallest balance—attack that one first. When it’s gone, roll payments to the next target. Many find motivation in visible progress.

Debt Avalanche Method

Math-driven savers prefer this method. List debts by interest rate, starting with the highest. You’ll save more on charges over time. It requires patience but maximizes long-term savings.

| Method | Focus | Best For |

|---|---|---|

| Snowball | Small balances first | Needing quick motivation |

| Avalanche | High-interest debts | Minimizing total costs |

Sarah, a nurse from Texas, shares: “Snowball kept me going—crossing off accounts felt like leveling up!” Others, like software engineer Mark, prefer avalanche: “Saving $3k in interest made slower wins worth it.”

Before choosing a repayment plan, list all balances and rates. Decide if momentum or math matters more. Either way, consistency turns small steps into big results.

Exploring the Debt Snowball Method

Staring at multiple balances can freeze your progress. The debt snowball method turns this paralysis into action by focusing on small wins first. It’s like knocking down dominoes—each paid-off account fuels momentum for the next challenge.

Mechanics of the Snowball Approach

Start by listing every debt from smallest to largest balance. Pay minimums on all except your tiniest obligation—attack that one with extra cash. Once it’s gone, roll those payments to the next target.

Imagine three accounts:

- $1,100 credit card (19% APR)

- $3,000 store card (23% APR)

- $9,000 personal loan (11% APR)

You’d crush the $1,100 balance first, even though it’s not the priciest. Why? Quick victories build confidence. “Crossing off that first debt made me believe I could do it,” says Jake, a Colorado mechanic.

Advantages and Drawbacks

This strategy shines for those needing emotional wins to stay motivated. Seeing balances disappear fast keeps frustration at bay. But there’s a trade-off: prioritizing small debts over high-interest ones may cost more over time.

For example, paying $500 monthly on the $1,100 credit card clears it in 3 months. However, the $3,000 store card’s 23% rate keeps growing during that time. Math-focused planners might prefer other methods, but for many, momentum outweighs pure numbers.

Understanding the Debt Avalanche Method

Tackling high-interest balances first can feel like solving a math puzzle—challenging but rewarding. This strategy targets your costliest debts upfront, potentially saving hundreds in fees over time. Let’s explore how this method works and whether it fits your financial personality.

Prioritizing High-Interest Debt

The avalanche approach sorts obligations by interest rate, not balance size. For example:

- A $5,000 credit card charging 24% APR comes first

- A $2,000 medical bill at 18% follows

- A $15,000 student loan with 6% interest goes last

You’ll pay minimums on all accounts except the priciest one. Extra funds attack that balance until it’s gone. “I saved $1,700 in my first year by focusing on my 26% store card,” shares Derek, an engineer from Florida.

Pros and Cons Overview

This method shines for number-crunchers but demands patience. Benefits include:

- Lower total interest costs over time

- Faster overall debt elimination

Potential drawbacks:

- Slower visible progress (no quick wins)

- Requires strict budgeting discipline

While you might not celebrate paid-off accounts quickly, the math works in your favor. Those with steady incomes and detailed budgets often thrive with this approach. Just remember—consistency turns small sacrifices into big savings.

Implementing the Debt Consolidation Method

Feeling overwhelmed by scattered payments and confusing interest charges? Streamlining your debts through a structured approach can bring clarity. This method involves securing a single financial product to replace multiple obligations, but success depends on smart comparisons.

Steps to Secure the Right Plan

Start by reviewing your credit score and gathering details about current balances. Banks, credit unions, and online lenders offer different terms. Apply to multiple providers to increase approval chances and access better deals.

| Existing Debts | Consolidation Plan | Savings Potential |

|---|---|---|

| 24% average APR | 14% fixed rate | $1,500/year |

| 7 payment dates | 1 due date | Fewer late fees |

| $900 monthly total | $620 fixed | $280 monthly savings |

Smart Rate Comparisons

Calculate the weighted average of your current rates first. If a new offer’s APR falls below this number, you’ll save money. For example:

- $12,000 debt mix at 22% average → 15% consolidation rate saves $840 annually

- Always check origination fees and prepayment penalties

“I compared six lenders and found one that cut my interest by 9%,” shares Tina, a small business owner. Use free online calculators to test scenarios before committing. Remember—the right plan turns financial chaos into controlled progress.

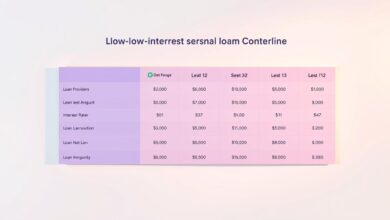

Comparing Debt Consolidation Options

Choosing between different debt solutions can feel like navigating a maze. Each path offers unique benefits and challenges for your financial journey. Let’s break down four common strategies to help you find the right fit.

Traditional Refinancing vs. Structured Plans

A debt consolidation loan works best if you have good credit and steady income. This option lets you refinance multiple balances into one fixed-rate payment. Banks typically offer lower rates than credit cards—but approval depends on your financial history.

Debt management programs take a different approach. Credit counseling agencies negotiate with creditors to reduce interest rates. You’ll make a single monthly payment to the agency, which distributes funds. “My rates dropped from 22% to 9% without taking out new credit,” shares Kyle, a graphic designer from Arizona.

Negotiation-Based Solutions

Debt settlement programs aim to reduce what you owe—sometimes by half. However, missed payments during negotiations can hurt your credit score. Creditors aren’t required to agree, leaving outcomes uncertain.

Consumer proposals provide legal protection while settling debts. Administered through licensed professionals, these plans let you pay a portion over five years. They stay on your credit report for three years after completion, affecting future borrowing power.

| Option | Credit Impact | Timeframe |

|---|---|---|

| Consolidation Loan | Minor dip initially | 2-7 years |

| Management Program | Varies | 3-5 years |

| Settlement | Severe damage | 1-3 years |

| Consumer Proposal | Lasting marks | 5+ years |

Role of Financial Institutions and Credit Counsellors

Navigating debt solutions requires understanding who can help. Banks and nonprofit agencies offer different paths—one focuses on products, the other on personalized strategies. Knowing these differences helps you choose support that matches your goals.

Bank Services vs. Holistic Guidance

Traditional institutions like credit unions provide tools to manage payments. You might qualify for balance transfer cards or fixed-rate products. These options work well if you need structure but already understand budgeting basics.

| Service Type | Bank Programs | Credit Counseling |

|---|---|---|

| Primary Focus | Loan approvals | Financial education |

| Support Features | Online portals | Custom repayment plans |

| Long-Term Impact | Credit score changes | Habit-building resources |

Expert-Led Financial Recovery

Certified counselors dig deeper than monthly payments. They review spending patterns, negotiate rates, and explain all options—including debt management programs. “My counselor showed me how to save $300/month without drastic cuts,” shares a Minnesota retail manager.

Licensed Insolvency Trustees (LITs) add legal expertise for complex cases. These government-regulated professionals create tailored strategies, whether you need mild adjustments or major overhauls. Their advice stays neutral—no commissions from selling specific products.

While banks handle transactions, counselors build financial resilience. Pairing their services often yields the best results: immediate relief through banking tools, lasting change through expert guidance.

Budgeting and Calculating Your Savings

Creating a clear budget transforms guesswork into progress. Start by listing every expense and income source. Tools like spreadsheets or apps help visualize where your money goes each month. This clarity reveals hidden spending patterns—like daily coffee runs adding up to $75 monthly.

Next, compare interest rates across your accounts. Moving high-cost balances to lower-rate plans can slash hundreds in annual fees. For example, shifting $8,000 from a 22% card to a 12% option saves $800 yearly. Use free online calculators to test different scenarios.

Automate your new payment plan to avoid missed deadlines. Many find success allocating 20% of their income toward debt while building a small emergency fund. “Seeing my savings grow kept me motivated,” shares a Florida teacher who paid off $14,000 in 18 months.

Regular check-ins ensure your strategy stays effective. Adjust as life changes—raises, new bills, or unexpected costs. With consistent tracking and smart rate comparisons, you’ll turn financial stress into measurable wins.