Discover Fast Quick Loans with Simple Application

Unexpected expenses don’t wait for payday. Whether it’s a car repair or a time-sensitive opportunity, having access to fast funding can make all the difference. Modern financial solutions have transformed how Americans handle emergencies, offering streamlined processes that fit busy schedules.

Gone are the days of waiting in bank lines. Companies like Magical Credit simplify borrowing with applications that take just 5 minutes and loan amounts from $1,500 to $20,000. Need smaller amounts? My Canada Payday delivers up to $1,500 via Interac e-Transfer within 15 minutes of approval.

These services bridge gaps between paychecks securely. Cash Money stands out with flexible options like auto equity loans and lines of credit up to $10,000. Every lender mentioned follows strict provincial regulations, ensuring transparent terms and responsible practices.

You’ll learn how to navigate eligibility requirements and compare lenders effectively. Let’s explore how today’s digital tools put financial control at your fingertips – no paperwork or branch visits required.

Key Takeaways

- Modern lenders offer funding decisions in minutes, not days

- Loan amounts range from $1,500 to $20,000 based on provider

- Online applications eliminate physical paperwork and branch visits

- Reputable companies prioritize security and regulatory compliance

- Multiple loan types address different financial needs

Introduction to Quick Loans

Immediate cash needs can’t always wait for lengthy approval processes. Short-term financial solutions fill this gap by offering same-day decisions and flexible criteria. Unlike traditional bank requirements, these options prioritize your current income over past credit challenges.

Specialized lenders like Magical Credit focus on accessibility. They accept diverse income sources – pensions, unemployment benefits, or child tax credits – making funds available to more people. This approach helps those rebuilding their credit history while addressing urgent expenses.

The finance industry has evolved to serve overlooked communities. Modern providers assess repayment capacity through banking patterns rather than rigid score thresholds. You’ll find options ranging from 90-day plans to revolving credit lines, each designed for specific situations.

Regulated lenders ensure transparent terms and consumer protections. Whether covering medical bills or seizing limited-time opportunities, these tools provide a safety net without long-term debt commitments. Always verify a company’s provincial licensing before applying.

Quick Loans: Fast Access to Cash

When urgent financial needs strike, waiting days for money isn’t practical. Leading providers now deliver cash directly to your bank account in hours – sometimes minutes. My Canada Payday sets the standard with Interac e-Transfers landing in 15 minutes after approval, while Cash Money matches this speed for amounts up to $10,000.

Automated approval systems work 24/7, bypassing traditional banking hours. Magical Credit deposits funds within 24 hours, using secure electronic transfers that skip paper checks. This technology eliminates branch visits and lets you manage everything from your phone or computer.

Direct deposit partnerships between lenders and financial institutions keep transactions smooth. These relationships ensure approved money arrives right away, even during weekends or holidays. You’ll see the funds reflect in your account balance almost instantly.

Speed matters most during emergencies like medical bills or car repairs. Modern financial tools turn what used to be a multi-day process into a same-day solution. Just confirm your income details online, and you’re minutes away from resolving pressing expenses.

Easy Online Application Process

Submitting a financial request now fits into coffee break timelines. Leading providers like Magical Credit and My Canada Payday have transformed applications into 5-minute tasks – no printer or fax machine required. You’ll need basic personal details and your smartphone to start.

Step-by-Step Application

Modern forms adapt to any device – smartphone screens or laptop keyboards. Start by entering your contact information and employment status. Most platforms auto-save progress if you need to pause.

Banking verification happens through secure portals instead of paperwork scans. “We use military-grade encryption to protect every upload,” notes Magical Credit’s compliance officer. Automated checks cross-reference your details while you finish typing.

| Traditional Process | Modern Solution |

|---|---|

| 1-hour paperwork | 5-minute digital form |

| Fax machine required | Secure cloud uploads |

| 3-day verification | Instant system checks |

Security and Privacy Assurance

Every application uses TLS 1.3 encryption – the same standard banks employ. Servers automatically purge sensitive data after verification. You control what information lenders retain post-approval.

Multi-factor authentication protects your account during submission. Unlike old-school methods requiring notarized documents, modern systems validate your identity through banking patterns. This streamlined approach maintains safety while eliminating delays.

Benefits of Quick Loans

Modern financial solutions prioritize speed and simplicity. Borrowers gain clarity faster than traditional methods allow, with approval decisions often arriving within hours. This efficiency helps people address pressing needs without prolonged uncertainty.

Fast Approval and Direct Deposit

Same-day funding eliminates stressful waiting periods. Magical Credit deposits approved amounts directly into accounts within 24 hours – no check-cashing trips or branch visits required. Automated systems sync with banking networks to transfer funds securely, even outside business hours.

Over 10,000 customers have experienced this streamlined approach. One borrower shared: “The money appeared in my account before I finished lunch.” These digital transfers work 365 days a year, turning emergencies into manageable situations.

Minimal Paperwork and Friendly Service

Gone are stacks of forms and notarized documents. Most requests require just three items:

- Government-issued ID

- Recent pay stub

- Active bank account

Knowledgeable staff guide applicants through each step. Magical Credit’s team answers questions in plain language, avoiding confusing financial jargon. Their service philosophy focuses on empathy – staff members train extensively to understand urgent financial pressures.

This human touch complements digital convenience. Borrowers can switch between online portals and phone support without restarting their applications. It’s financial help designed for real life, not just spreadsheets.

Eligibility and Required Documentation

Meeting eligibility requirements for financial assistance is simpler than many expect. Lenders focus on current stability rather than past financial missteps. Most providers ask applicants to meet three basic criteria: be at least 18 years old, have permanent residency, and maintain a steady income source.

Income and Banking History

Providers verify repayment capacity through employment records or bank account activity. Magical Credit requires six months of consistent earnings or government support payments. My Canada Payday checks 180 days of banking history to assess money management habits.

| Provider | Income Proof | Banking History |

|---|---|---|

| Magical Credit | 6 months employment/gov’t income | Active direct deposit |

| My Canada Payday | Local steady job | 180-day account history |

Even with bad credit, applicants can qualify by showing regular deposits. Lenders review recent pay stubs or benefit statements instead of traditional credit reports. This approach helps those rebuilding their financial standing.

Alternative Income Sources

Government support programs count toward eligibility. Magical Credit accepts unemployment benefits, disability payments, and pension plans. Child tax credits and workers’ compensation also qualify as valid income sources.

These flexible criteria expand access to funds during temporary hardships. Providers analyze overall cash flow rather than credit scores alone. Direct deposit setups streamline both verification and repayment processes, creating a hassle-free experience.

Flexible Repayment Options

Financial flexibility starts with payment plans that adapt to your life. Leading providers like Magical Credit design schedules around your income patterns, helping you manage obligations without stress. Whether you need short-term solutions or extended terms, modern tools put you in control.

Aligning Payments With Your Budget

Bi-weekly options sync perfectly with paycheck cycles. Deducting smaller amounts right after payday helps maintain cash flow for other essentials. For those preferring longer intervals, monthly plans provide breathing room while keeping progress steady.

Magical Credit offers three main schedules:

- Single-payment for small, temporary needs

- Semi-monthly deductions matching dual pay periods

- Extended terms spreading costs over several months

Early repayment saves interest without penalties. “We encourage borrowers to adjust as their situation improves,” notes a Magical Credit advisor. This approach helps reduce debt faster while building positive credit history through reported on-time payments.

Customer teams can modify schedules if job changes or emergencies occur. This safety net prevents defaults and maintains financial momentum. Choosing the right term creates stability instead of strain – because real flexibility means plans that evolve with you.

Comparing Quick Loans to Traditional Lending

Financial decisions often come down to balancing speed with long-term value. Traditional banks and modern lenders serve different needs, each with distinct advantages. Let’s break down how these options stack up in critical areas.

Speed and Convenience vs. Traditional Banks

Time-sensitive needs demand rapid solutions. Banks typically take 3-7 business days for approval, requiring in-person appointments and physical documentation. Modern providers like Magical Credit deliver decisions in hours through fully digital processes.

| Factor | Traditional Banks | Modern Lenders |

|---|---|---|

| Approval Time | 1-2 weeks | 1-24 hours |

| Documentation | Tax returns, collateral proof | Digital ID + income verification |

| Credit Checks | Strict score requirements | Banking history focus |

This streamlined approach helps people address emergencies without waiting. Online applications work around your schedule – no need to take time off for bank visits.

Cost and Interest Rate Differences

While banks offer lower rates (often 6-10% APR), their strict qualifications exclude many borrowers. Modern lenders charge higher interest (19.99%-35% APR) but provide access when traditional options aren’t available.

- Bank personal loans: 5-7 day approval, 6-10% APR

- Installment loans: 19.99%-35% APR, same-day funding

- Payday loans: $14/$100 borrowed, 15-minute transfers

These solutions make sense for short-term gaps rather than multi-year financing. As one financial advisor notes: “Quick options cost more but prevent larger expenses like overdraft fees or missed opportunities.”

Choose based on urgency and repayment capacity. Banks work best for planned expenses with perfect credit, while alternative lenders help bridge immediate needs with flexible criteria.

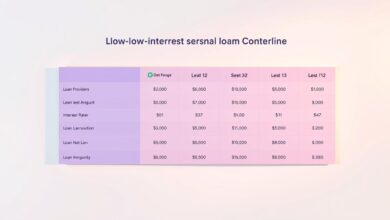

Understanding Interest Rates and Loan Terms

Borrowing costs become clearer when you decode how rates work. Let’s break down a $300 payday loan with a 14-day term. You’d pay $42 in fees ($14 per $100) – that’s 365% APR. But monthly interest tells a different story.

Installment products like Magical Credit’s offerings use lower APRs (19.99%-35%). A $1,500 amount over 12 months at 2.9% monthly adds $525 total. Longer terms spread costs but increase overall fees.

| Loan Type | Amount | Term | Total Cost |

|---|---|---|---|

| Payday | $500 | 14 days | $570 |

| Installment | $1,500 | 1 year | $2,025 |

Provinces cap charges – Ontario limits payday loan fees to $15 per $100. Always check your region’s rules. Larger amounts often work better with installment plans, while small needs might suit short-term options.

APR helps compare annual costs across products. Monthly rates show immediate impacts. A 30% APR equals 2.5% monthly. Use both numbers to budget effectively.

Review every fee schedule before signing. Reputable lenders outline costs upfront. Knowing your total repayment helps avoid surprises and builds financial confidence.

Securing Your Funds and Protecting Your Privacy

Your financial safety should never be an afterthought when accessing emergency funds. Modern providers use advanced tools to safeguard transactions while maintaining transparency. These systems work silently in the background, letting you focus on solving urgent needs with confidence.

Instant Bank Verification

Real-time verification replaces outdated paperwork. Platforms like Magical Credit connect securely to your bank through encrypted portals, confirming account details in seconds. This process uses bank-level encryption without storing login credentials.

Approval systems cross-check your information against national databases during submission. You’ll know immediately if additional documentation is needed, avoiding delays. This method reduces fraud risks while speeding up funding timelines.

Data Security

Every application employs TLS 1.3 encryption – the same standard protecting online banking. Multi-factor authentication adds another layer, requiring confirmation via text or email before accessing sensitive data.

Servers automatically purge personal details after verification. You decide what information lenders retain post-approval. Regular third-party audits ensure compliance with federal privacy laws, giving peace of mind with every transaction.