Same Day Loans: Instant Decisions & Fast Funding

Unexpected expenses don’t wait for payday. When urgent bills or emergencies strike, quick cash solutions can bridge the gap between stress and stability. Modern lenders now offer rapid approval processes, with some providing funds in as little as 15 minutes after approval. This speed makes these options ideal for covering car repairs, medical bills, or last-minute opportunities.

Leading providers like OneMain Financial and Wise Loan simplify access to emergency funding. Borrowers can request amounts from $500 to $20,000, with clear terms and fixed payments. Applications take minutes to complete online, eliminating the paperwork hassles of traditional banks. Approval decisions often come instantly, and funds typically arrive the same business day if timing aligns.

These services prioritize convenience, operating 24/7 through digital platforms. Whether you’re facing a midnight emergency or a midday crisis, help is just a few clicks away. With transparent fees and straightforward requirements, borrowers can secure money without lengthy delays.

Key Takeaways

- Emergency funding arrives within hours, with some lenders offering instant transfers in 15 minutes

- Loan amounts range from $500 to $20,000 to match different financial needs

- Digital applications provide 24/7 access and eliminate traditional paperwork

- Fixed payment plans create predictable budgeting for repayment

- Approval decisions often occur within minutes of application submission

Overview of Same Day Loans

Financial emergencies demand solutions that match their urgency. Modern lenders now offer tailored options to address sudden expenses, blending speed with clear repayment structures. These services bridge the gap between urgent requirements and conventional banking timelines.

What Are Swift Approval Options?

Emergency funding through personal loans provides immediate relief for costs like medical bills or home repairs. Unlike traditional bank products, these solutions prioritize rapid processing—often completing approvals in under an hour. One borrower shared: “When my refrigerator broke, having funds in my account by afternoon saved hundreds in spoiled groceries.”

| Feature | Traditional Options | Modern Solutions |

|---|---|---|

| Approval Time | 3-7 days | 15 minutes – 2 hours |

| Documentation | Pay stubs, collateral | Basic income verification |

| Funding Speed | Next-week transfer | Same-business-day deposit |

| Repayment | Variable rates | Fixed installments |

Essential Characteristics of Quick Funds

Leading providers combine digital convenience with straightforward terms. Key aspects include:

- Online applications accessible 24/7 from any device

- Automated systems that review applications instantly

- Installment plans with fixed monthly payments

As financial advisor Rachel Torres notes:

“Accessible credit options empower individuals to handle crises without long-term debt cycles.”

This approach helpspeopleaddress pressingneedswhile maintaining budget control through predictable repayment schedules.

Benefits of Instant Decisions and Fast Funding

When urgent bills demand immediate action, waiting becomes a luxury you can’t afford. Modern financial solutions now deliver answers and money faster than ever before. This shift transforms stressful situations into manageable challenges.

Speedy Cash Solutions

Leading providers like OneMain Financial can deposit funds within an hour of finalizing agreements. Wise Loan takes this further, completing transfers in 15 minutes for qualified applicants. These systems work tirelessly – even at midnight or during holidays – to serve customers when traditional banks can’t.

Imagine avoiding late fees because your payment arrived before the deadline. Picture handling a flat tire without missing work. Rapid approval processes make these scenarios possible by cutting through red tape. As one user shared:

“The entire application took eight minutes. By lunchtime, my car repair was covered.”

Key advantages include:

- 24/7 automated systems that review requests instantly

- Flexible transfer speeds matching your urgency level

- Clear communication about deposit timelines

This approach respects your time while addressing critical needs. Whether facing medical bills or last-minute travel, swift service keeps life moving forward without financial roadblocks.

How Same Day Loans Work

Understanding the mechanics behind rapid funding options demystifies borrowing. These solutions combine digital efficiency with clear criteria, turning hours of stress into minutes of action. Let’s explore how modern lenders deliver funds while you’re still processing the emergency.

Loan Approval Process

Getting started takes three simple steps. First, complete a digital application requiring basic income details and identification. Automated systems then analyze your credit history and employment status—often bypassing traditional score obsessions. As financial tech expert Mark Rivera observes:

“Modern underwriting looks at cash flow patterns, not just three-digit numbers. This shift helps responsible borrowers access fair terms.”

Most providers use soft credit checks during initial reviews, protecting your score. You’ll typically see:

- Decisions within 15 minutes

- Flexible criteria focusing on repayment capacity

- Electronic account verification through secure portals

Funding Timeline and Method Options

Once approved, funds race toward your account faster than pizza delivery. Many lenders complete transfers in under 60 minutes via:

- Direct deposit to your bank

- Instant debit card reloads

- Digital wallet integrations

Timing depends on your bank’s processing—early applications often see money by lunchtime. This speed transforms financial crises into manageable bumps rather than roadblocks.

Fast Funding Options and Approval Process

Time transforms from ally to adversary when bills strike. Modern lenders offer multiple pathways to receive money, each designed for specific urgency levels. Let’s explore how these systems work and what you need to prepare.

Instant Funding Explained

Lightning-fast transfers arrive in 15 minutes for eligible applicants. This option requires a debit card linked to your active checking account. As borrower Jessica Monroe shared:

“I received confirmation texts faster than my Uber Eats order. The money beat the tow truck to my location!”

Digital systems verify account details instantly, skipping manual reviews. Funds appear before you finish your coffee.

Same Day vs Next-Day Funding

Compare these options using real-world scenarios:

| Type | Speed | Transfer Method | Requirements |

|---|---|---|---|

| Instant | 15 minutes | Debit card network | Linked card & account |

| Same-Day | By 5 PM CT | ACH transfer | Application by 1:30 PM CT |

| Next-Day | 24 hours | EFT transfer | Standard verification |

Bank Transfer Requirements

Your account must meet three criteria:

- Active checking status (no savings accounts)

- Account holder name matches application

- Capability to receive electronic transfers

Weekend requests may delay deposits until Monday. Most providers charge zero fees regardless of transfer speed. Always confirm your bank’s processing times to avoid surprises.

Emergency Cash Solutions for Urgent Needs

Life’s urgent moments require immediate financial action. Whether facing medical crises or sudden home repairs, emergency cash solutions offer breathing room when savings fall short. These options provide temporary relief without draining future resources.

When to Consider an Emergency Loan

Medical bills often arrive unannounced. An emergency loan helps cover hospital visits, dental emergencies, or specialized care for family members. As financial planner Derek Mills notes:

“Smart borrowing prevents small crises from becoming long-term money problems.”

Home improvement emergencies demand quick fixes. Burst pipes or broken furnaces can’t wait for insurance payouts. Immediate funds prevent costly secondary damage while keeping families safe.

Vehicle breakdowns disrupt work commutes and childcare routines. Quick cash access keeps cars running and paychecks flowing. Similarly, time-sensitive travel for funerals or family emergencies becomes manageable with same-business-day funding.

Critical bills like overdue rent or utility shutoff notices often come with tight deadlines. Emergency money solutions bridge gaps between due dates and paychecks. They also help consolidate high-interest debts into single payments with better terms.

Job loss or reduced income creates temporary challenges. These loans cover essentials while rebuilding stability. Life events like divorce proceedings or unexpected legal fees also qualify for urgent financial support.

Responsible use of emergency funds protects credit scores and prevents long-term stress. Always compare lenders to find flexible repayment plans that fit your budget.

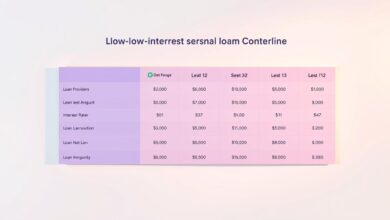

Clear Payment Terms and Competitive Rates

Financial clarity transforms borrowing from stressful to manageable. Modern lenders prioritize transparency, showing exact costs before you commit. This upfront approach builds trust while helping you make informed decisions.

Understanding Interest Rates

Fixed rates lock in your borrowing costs, shielding you from market fluctuations. OneMain Financial displays rates clearly during applications—no hidden math. As financial counselor Lisa Yang explains:

“Knowing your exact interest percentage prevents bill shock. It turns repayments into predictable line items, not budget busters.”

Borrowers with strong credit often secure rates under 10%, while others access fair terms based on income stability. Loyal customers sometimes earn discounts through repeat relationships with lenders.

Predictable Repayment Plans

Installment structures break payments into equal monthly chunks. You’ll see:

- Exact due dates matching your pay schedule

- Principal/interest breakdowns for each payment

- Options for 3-month to 5-year terms

Automatic withdrawals simplify budgeting while often earning 0.25% rate reductions. This system creates a clear path to debt-free status without guesswork.

| Loan Amount | Typical Term | Monthly Payment |

|---|---|---|

| $1,000 | 12 months | $89-$102 |

| $5,000 | 36 months | $148-$175 |

| $10,000 | 60 months | $190-$225 |

These sample figures show how structured plans keep finances stable. Whether covering car repairs or medical bills, you’ll always know what’s due—and when.

Streamlined Application Process for Quick Approval

Modern financial solutions remove barriers when time matters most. The digital approach to securing funds prioritizes speed without sacrificing security. You’ll find no stacks of paperwork or week-long waits here—just straightforward steps designed for real-life urgency.

Simple Online Application Steps

Getting started takes less time than brewing coffee. Most platforms guide you through three basic fields: personal details, income verification, and banking information. As financial expert Derek Mills explains:

“Today’s systems validate employment in real-time, turning hours of documentation into seconds of confirmation.”

Lenders focus on your current ability to repay rather than past credit challenges. While they review your credit history, many prioritize consistent income and stable employment. This balanced approach helps borrowers with less-than-perfect scores access fair terms.

Key features include:

- Mobile-friendly forms accessible 24/7

- Instant alerts about missing information

- Encrypted data protection throughout the process

Advanced algorithms analyze your application while you wait, often delivering decisions before you finish checking email. This efficiency proves crucial when facing deadlines for medical bills or car repairs. With transparent requirements and no hidden fees, you can focus on solutions rather than paperwork.

Customer Success Stories and Feedback

Real experiences from borrowers highlight the impact of reliable financial support. Thousands of users share how service quality and speed transformed their financial challenges into success stories.

Real User Testimonials

“The entire process took two hours – faster than my doctor’s appointment,” explains Maria, who secured funds for home repairs. Another customer notes: “Rocket’s loyalty discount saved me $1,200 compared to payday loans.”

Highlights from Positive Reviews

With 4.9-star ratings across platforms, customers praise three key strengths:

Friendly guidance: Staff explain options clearly, helping borrowers choose suitable loan amounts. Rapid solutions: 78% complete applications during lunch breaks or commutes.

Many use funds for debt consolidation or urgent home projects. One parent shared: “This personal loan let me fix our car before school pickup.”