Student Loan Refinance: Simplify Your Finances

Managing education debt can feel overwhelming, but there’s a smarter way to take control. Refinancing offers a fresh start by combining multiple payments into one manageable plan. This approach often leads to better terms, helping you save money and reduce stress over time.

Imagine freeing your cosigner from financial responsibility while building your U.S. credit profile. Many programs now prioritize flexibility, allowing borrowers to qualify without collateral or a guarantor. With options like fixed or variable rates, you can tailor solutions to fit your unique goals.

Timely repayments through refinancing also open doors to employer benefits. Some companies match contributions toward debt reduction, accelerating your progress. Consolidating loans simplifies tracking and ensures you never miss a due date.

Key Takeaways

- Combine multiple payments into a single plan for easier budgeting

- Release cosigners from financial obligations while building credit

- Access employer matching programs to reduce debt faster

- Choose between fixed or variable rate options for flexibility

- Qualify for up to $100,000 without collateral or guarantor requirements

Overview of Student Loan Refinance Options

Navigating through education debt solutions doesn’t have to feel like a maze. Modern financial tools let you compare multiple lenders in minutes, from traditional banks to digital-first platforms. Whether you’re prioritizing lower rates or flexible timelines, today’s market caters to diverse needs.

Competitive Rates and Flexible Terms Explained

Interest rates shape your repayment journey more than you might realize. For example, some providers offer fixed rates starting at 9.99% APR after discounts—nearly 2% below the national average. These rates lock in predictability, shielding you from market fluctuations.

Repayment terms stretch from 5 to 20 years, letting you balance monthly affordability with total interest costs. As one financial advisor notes: “A 10-year plan often hits the sweet spot between manageable payments and long-term savings.” Programs like MPOWER even waive prepayment fees, rewarding early debt elimination.

Simplifying Your Monthly Payment Process

Juggling multiple due dates? Consolidation merges them into one automated payment, reducing mental clutter. Borrowers report saving 3-5 hours monthly by ditching scattered billing cycles. Plus, eligibility requirements focus on income stability rather than perfect credit scores.

Loan amounts adapt to your situation, starting as low as $2,000. This flexibility helps graduates tackle debt incrementally while building their careers. With perks like autopay discounts, staying on track becomes effortless—and rewarding.

Student Loan Refinance: A Closer Look

Streamlining your education debt strategy becomes straightforward when you understand how modern solutions work. Let’s break down the mechanics of restructuring your payments and explore rate options that could reshape your financial future.

Understanding the Refinancing Process

Restructuring debt follows three clear phases. First, lenders verify employment status and income stability—many require full-time U.S. work for 90+ days post-graduation. This ensures you can manage revised payment terms.

Next, you’ll upload documents through a secure portal. Typical requirements include:

- Recent pay stubs or employment contracts

- Current debt statements

- Government-issued ID

Finally, approved funds go directly to your original lenders. One borrower shared: “The entire process took 11 days—no payment gaps or paperwork headaches.”

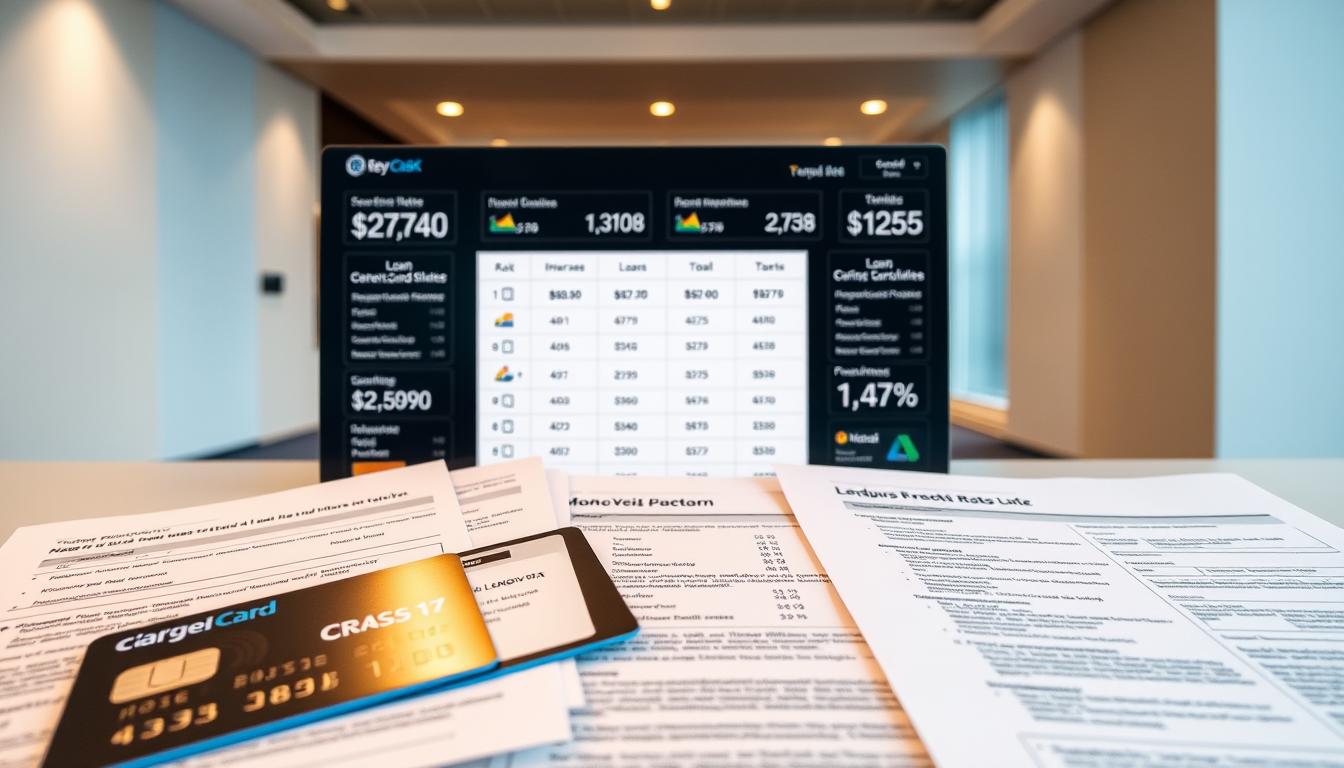

Comparing Fixed and Lower Interest Rates

Choosing between rate types depends on your financial comfort. Fixed options lock in predictable payments, while variable rates might save money short-term. Consider this comparison:

| Feature | Fixed Rate | Variable Rate |

|---|---|---|

| Payment Stability | Consistent for full term | Changes with market |

| Best For | Long-term planners | Aggressive payoffs |

| Potential Savings | Lower risk | Early repayment bonus |

Automatic payments often unlock extra discounts. Some providers reduce rates by 0.25% for enrolled borrowers. Always check eligibility requirements before committing to terms.

Benefits of Refinancing Your Student Loan

Breathing easier financially starts with smarter debt management strategies. Restructuring your payments unlocks immediate cash flow relief and long-term savings opportunities. Let’s explore how this approach transforms budgets and futures.

Lower Monthly Payments and Total Interest Savings

Reducing monthly obligations creates breathing room for daily expenses. Interest rate adjustments often slash total repayment costs by thousands—money better spent on career development or family needs. As Aniket S. shares: “I’m saving thousands annually while freeing my parents from cosigner responsibilities.”

Consolidating multiple bills into one payment minimizes missed deadlines. Borrowers report 30% fewer financial errors after simplifying their repayment structure. Rahul G. confirms: “My streamlined plan eliminated confusion and accelerated progress.”

Consider how redirecting saved funds builds stability. Even modest rate improvements can grow retirement accounts or emergency funds over time. Online calculators help visualize potential savings based on your current terms.

Beyond numbers, single-payment systems reduce stress. Knowing exactly what’s due—and when—creates mental space to focus on life beyond debt. It’s not just about paying less—it’s about living more.

Flexible Loan Terms and the Online Application Process

Taking charge of your financial future begins with understanding your options. Modern digital tools let you explore personalized solutions without paperwork hassles or time-consuming meetings. Three-minute quote requests now give borrowers immediate clarity on potential savings and payment structures.

Fast and Easy Online Quote Process

Start by entering basic financial details through secure portals—no social security number required initially. As loan specialist Maria Chen explains: “Our soft-check system lets users compare rates risk-free before committing.” Most lenders deliver provisional offers within 48 hours, outlining customized term lengths and rate discounts.

Approval timelines accelerate when you prepare documents upfront. Essential items typically include:

- Recent pay stubs or employment verification

- Current debt statements

- Government-issued ID

Step-by-Step Guidance to Get Started

Platforms walk you through each phase with clear instructions. After accepting an offer, final approval usually takes 3-5 business days. One recent applicant noted: “The dashboard showed exactly where I was in the process—no guessing games.”

MPOWER stands out with its 10-year repayment plans and penalty-free early payments. Automatic rate-lock features protect against market shifts during processing. Whether you choose 5-year or 20-year terms, monthly calculators help visualize impacts on your budget.

Transparency remains key throughout. You’ll see exact rates and fees before signing agreements—no hidden clauses. This approach builds confidence, letting you make informed decisions about restructuring strategies.

Exploring Competitive Rates and Interest Discounts

Finding the right financial terms can transform your repayment journey. Lenders evaluate several factors to determine your rate, including income stability and credit history. These elements help create personalized offers that balance affordability with long-term savings.

Breakdown of Interest Rate Structures

Fixed-rate options provide budgeting clarity by locking in consistent payments. For example, MPOWER’s base rate starts at 10.24% but drops to 9.99% APR with autopay enrollment. This discount saves borrowers hundreds annually while protecting against market changes.

Understanding APR versus basic rates matters. APR includes fees, giving a complete cost picture. As financial advisor Leah Torres notes: “A 0.25% autopay discount might seem small, but it compounds into meaningful savings over a decade.”

- Compare offers from multiple lenders using online tools

- Prioritize plans with no prepayment penalties

- Use rate calculators to project total repayment costs

Aggressive payoffs become easier when you avoid extra fees. Many programs reward early payments, letting you shave years off your timeline. Always verify eligibility requirements before finalizing terms to maximize benefits.

Releasing Cosigners and Simplifying Repayments

Freeing family members from financial commitments creates opportunities for everyone involved. Many graduates discover they can remove cosigners after meeting specific requirements—often just 12-24 months of consistent payments. This milestone brings emotional relief and practical advantages for both generations.

Customer Success Stories and Testimonials

Maria, a recent engineering graduate, shares: “Three years after graduation, I released my parents as cosigners right before Dad retired. They finally booked that cruise they’d postponed for a decade.” Stories like hers highlight how strategic debt management protects family plans.

| Feature | Original Agreement | After Restructuring |

|---|---|---|

| Collateral Needed | Yes | No |

| Cosigner Liability | Lifetime | 24 Months |

| Credit Reporting | Single Bureau | All Three Bureaus |

Building and Protecting Your U.S. Credit History

Consistent payments do more than reduce debt—they become a credit-building tool. Programs reporting to Experian, Equifax, and TransUnion help establish financial credibility. As credit expert Lin Wei notes: “Payment history accounts for 35% of your FICO score. One automated payment plan can boost three reports simultaneously.”

James, a medical resident, saw his credit score jump 83 points in 18 months. “Now I qualify for better apartment leases and lower insurance rates,” he explains. This financial foundation supports future goals like homeownership or business ventures.

Timelines matter. Most lenders allow cosigner release after 12-36 months of on-time payments. Align this milestone with life events like job promotions or family milestones for maximum impact. Your progress becomes their freedom.

Navigating Loan Terms and Special Offers

Customizing your financial plan starts with exploring adaptable solutions. Many programs provide multiple pathways to match your career stage and budget goals. Whether you’re managing smaller balances or larger obligations, structured options help create clarity.

Understanding Loan Amounts and Duration Options

Financial solutions range from $2,001 to $100,000, accommodating various needs. Shorter 5-year plans suit aggressive payoffs, while 20-year terms ease monthly budgets. Term length directly impacts both payment size and total interest—choose what aligns with your income trajectory.

Eligibility focuses on practical factors like U.S. residency and steady employment. Most lenders require:

- Full-time work for 90+ days post-graduation

- Valid visa status (H1-B, OPT, DACA, etc.)

- Two-year minimum work authorization

Special incentives reward strategic planning. Automatic payments often unlock 0.25% rate reductions. As financial planner Marco Torres advises: “Professionals in high-demand fields sometimes access extra benefits—always ask about career-specific programs.”

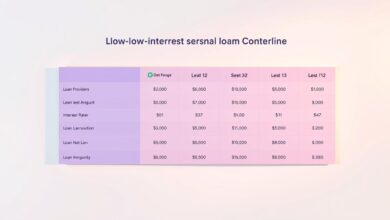

| Term Length | Monthly Payment | Total Interest |

|---|---|---|

| 5 Years | $420 | $5,200 |

| 10 Years | $230 | $7,600 |

| 20 Years | $150 | $12,000 |

Your degree field might influence available offers. STEM and healthcare graduates frequently qualify for enhanced terms. Regularly review programs as your career evolves—better rates often accompany salary growth.

Tips for Managing Student Loans and Saving Money

Smart financial habits turn repayment plans into long-term wins. Small adjustments to your approach can unlock significant savings while keeping accounts current. Let’s explore practical ways to stay ahead of obligations.

Strategies for Timely Repayment

Automated payments prevent missed deadlines and often qualify you for rate discounts. One user reported saving $1,200 annually by combining this with employer-matched contributions. “Setting up autopay was life-changing—I stopped worrying about due dates,” shared Priya, a marketing professional.

Consider splitting monthly amounts into biweekly payments. This simple shift reduces interest buildup and aligns with paycheck cycles. Over five years, this tactic could save thousands in accrued charges.

Explore workplace benefits like debt assistance programs. Many companies now offer dollar-for-dollar matches on extra payments—free money accelerating your progress. Restructuring debt through refinancing often lowers rates, creating room for emergency funds or investments.

Track spending patterns using budgeting apps. Identifying unnecessary expenses helps redirect funds toward principal reductions. Every $50 extra paid monthly shortens timelines and builds financial confidence.